Unveiling the Power of Residual Income Systems: A Comprehensive Review

Abstract:

In the dynamic landscape of personal finance and entrepreneurship, the concept of residual income has garnered significant attention. Residual income systems offer individuals the opportunity to generate continuous earnings with minimal ongoing effort, presenting an attractive prospect for financial stability and freedom. This review article delves into the fundamentals of residual income systems, explores various strategies and models, examines their advantages and limitations, and provides insights into their practical applications in today’s economy.

Introduction of Residual Income System:

Residual income, also known as passive income, is income that continues to be generated after the initial effort or investment has been made. Unlike active income, which requires constant time. And effort to maintain, residual income provides a stream of earnings that can persist over time with minimal ongoing involvement. Residual income systems encompass a wide range of strategies. And business models designed to create passive revenue streams, offering individuals the potential to achieve financial independence and build wealth.

>>Click instant access and other details<<

Fundamentals of Residual Income Systems:

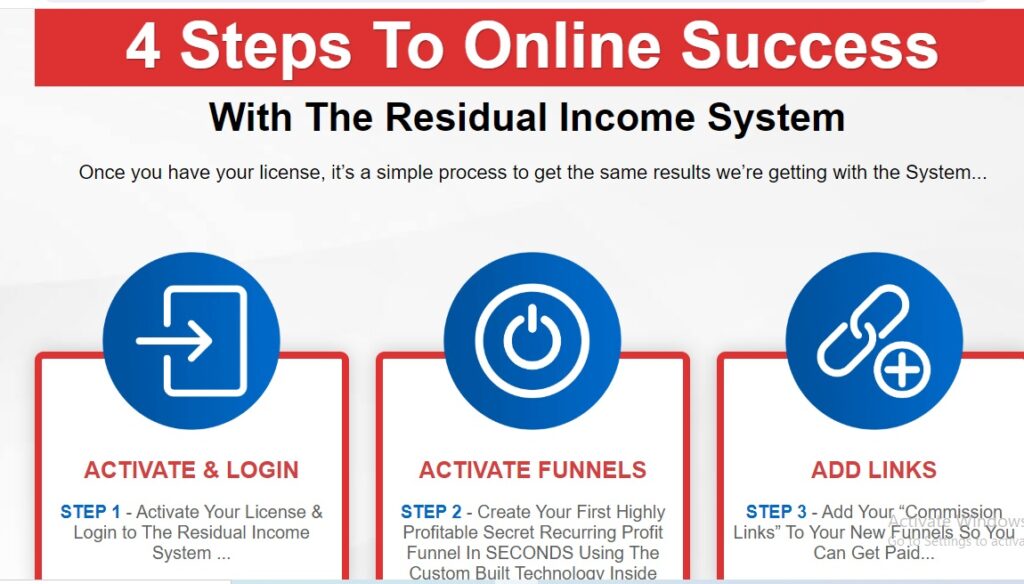

Definition and Conceptual Framework: Residual income systems operate on the principle of leveraging assets, resources. Or investments to generate recurring revenue streams. This can include rental income, royalties, dividends, interest from investments, affiliate marketing, and more.

Time and Effort Dynamics of Residual Income System:

One of the defining characteristics of residual income is its ability to decouple earnings from the direct exchange of time and effort. While initial investment or effort is required to establish the income stream, ongoing maintenance can be minimal, allowing individuals to earn money while focusing on other pursuits.

Sustainability and Scalability:

Successful residual income systems are sustainable and scalable, meaning they can generate consistent earnings over time. And have the potential for growth without proportional increases in input or effort.

Strategies and Models of Residual Income System:

Real Estate Investing: Rental properties and real estate investment trusts (REITs) are popular avenues for generating residual income through rental income and property appreciation.

Dividend Investing: Investing in dividend-paying stocks or dividend-focused mutual funds can provide ongoing passive income in the form of regular dividend payments.

Digital Assets and Online Businesses:

Creating and monetizing digital products, such as e-books, online courses, software. Or membership sites, offers opportunities for residual income in the digital economy.

Affiliate Marketing: Promoting products or services through affiliate programs. And earning commissions on sales generated through referral links is a common strategy for passive income generation.

Royalties and Licensing: Authors, musicians, artists, and inventors can earn residual income through royalties. And licensing agreements for their creative works or intellectual property.

>>Click instant access and other details<<

Advantages and Limitations of Residual Income System:

Advantages:

Financial Freedom: Residual income systems can provide a path to financial independence by diversifying income streams and reducing reliance on traditional employment.

Flexibility and Freedom: Passive income allows individuals to have more control over their time. And lifestyle, enabling them to pursue personal interests, spend time with family. Or explore new opportunities.

Wealth Building: Consistent passive income streams can facilitate long-term wealth accumulation through compounding returns and asset appreciation.

Limitations:

Initial Investment or Effort: Building a successful residual income stream often requires significant upfront investment. Or effort, whether in terms of capital, time, or skills.

Risk and Uncertainty: Like any investment or business endeavor, residual income systems entail risks, such as market fluctuations, economic downturns, or changes in regulations.

Maintenance and Management: While passive income requires less ongoing effort than active income, it still necessitates some level of maintenance, management. Or oversight to ensure continued profitability and sustainability.

Practical Applications of Residual Income System:Personal Finance and Wealth Management: Incorporating residual income strategies into personal finance plans can enhance financial resilience, security, and long-term wealth accumulation.

Entrepreneurship and Business Development: Entrepreneurs and business owners can leverage residual income models to diversify revenue streams, expand their market reach. And create sustainable businesses.

Retirement Planning: Residual income systems offer retirees the opportunity to supplement retirement savings. And pension income, ensuring financial stability and lifestyle maintenance in retirement.

Conclusion of Residual Income System:

Residual income systems represent a powerful paradigm shift in how individuals approach earning and managing income. By harnessing the principles of passive income generation, individuals can unlock opportunities for financial freedom, flexibility, and long-term wealth accumulation. While navigating the complexities and challenges inherent in residual income systems, strategic planning, diversification. And continuous learning are key to maximizing their benefits and mitigating risks. As the landscape of work and finance continues to evolve, understanding. And harnessing the potential of residual income systems will remain essential for individuals seeking financial independence and prosperity.

Overall, this comprehensive review underscores the significance of residual income systems as a transformative force in personal finance, entrepreneurship, and wealth creation.